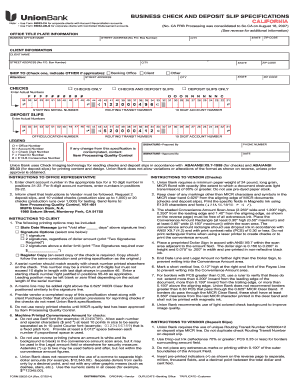

CA Union Bank form 55032-CA 2009 free printable template

Get, Create, Make and Sign

Editing union bank deposit slip online

CA Union Bank form 55032-CA Form Versions

How to fill out union bank deposit slip

How to fill out union bank deposit slip:

Who needs union bank deposit slip:

Video instructions and help with filling out and completing union bank deposit slip

Instructions and Help about union bank cheque deposit slip form

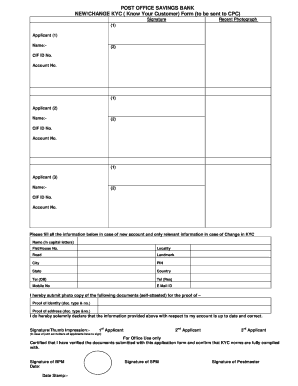

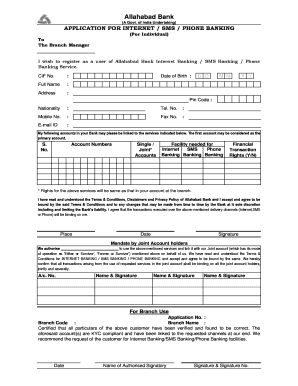

Hello I am a student of RN father School, and today I am going to tell you how to fill a deposit slip first a deposit slip has two sides the right one is to be submitted to the bank and the left one is kept with us suppose my name is Ram ADAV and I got this text from Mahesh then I can deposit this check and took my bank and I would get three thousand rupees but for that I need to fill in this deposit slip first your I would write the name of the branch where I am going to submit this check if I am going to deposit this check in the Santa Cruz branch here I would write Santa Cruz your I would write today's date which is six September here we need to write your own 15 digit unique account number here you need to write your own name if my name is Romney odd to right Ramirez then you need to write the details of the check this check is wrong Bank of India, so yeah Ave right Bank of India then this checks of the Sandra Karla complex branch, so you're out right beta Karla complex here I need to write the check number the check number are the first six digits which are written at the bottom of the check here the check number is 0 1 4 6 3 5, so you are at 0 1 4 6 3 5 here I will write the amount of the check which is 3000 here I will write the amount in words, so I will write 3,000 only and I would draw a line you're all right my contact number here you have to write a sign you need to cancel out this column now on the left side you will write today's date which is 6 September 2015 here you will write your own name which is Ram ADAV here I will write my own unique 15-digit account number you are alright the details of the check which is the bank name that is Bank of India here I will read the check number which are the first six digits 0 1 4 6 3 5 you are under at the amount which is 3000 here I will write the amount and words which is 3000 only in this way you fill a deposit cell when you are going to deposit this the check into the bank you need to attach the check here and submit it the bank person would give two stamps here, and he would share this and keep this part with him and this receipt would be with us while filling the deposit slip you need to keep these points in mind first write the name of the branch we are going to deposit the check then remember the unique 15-digit account number which is given to you then write the check details that is the name of the bank and the branch written on the check then write the check number the check number are the four six digits which are written at the bottom of the check then write the amount which is written on the check

Fill union bank slip : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your union bank deposit slip online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.